Credit Unions vs. Banks: Which is Right for You?

Credit Unions vs. Banks: Which is Right for You?

When it comes to managing your finances, one of the most important decisions you'll make is choosing between a credit union or a bank. Both institutions offer essential financial services such as savings and checking accounts, loans, and credit cards, but they differ in structure, accessibility, and overall benefits. Understanding these differences can help you make an informed choice that best aligns with your financial needs and goals.

What is a Credit Union?

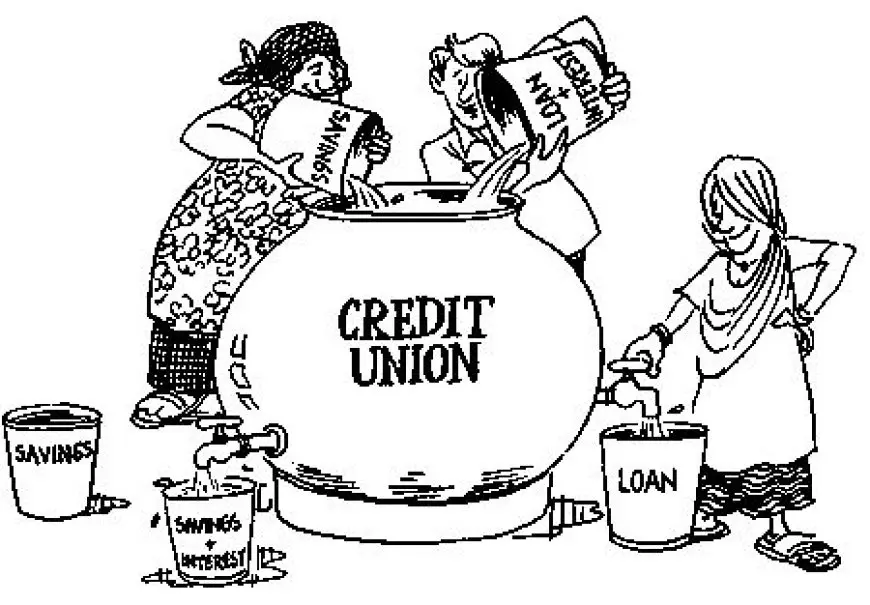

A credit union is a member-owned, non-profit financial institution that is typically smaller than a bank and focused on serving a specific community or group of individuals. Credit unions are built around the idea of helping members, and any profits earned are often reinvested into the institution to offer better services or lower rates.

Key Features of Credit Unions:

-

Non-Profit and Member-Owned: Since credit unions are owned by their members, their primary goal is to benefit members rather than shareholders. As a result, credit unions often offer lower fees and more favorable interest rates.

-

Personalized Service: Credit unions are known for providing more personal and tailored customer service. Since they often operate on a smaller scale, it’s easier for members to build relationships with staff and get more customized financial advice.

-

Lower Costs: Credit unions typically offer lower fees for accounts and services, as well as better interest rates on savings and loans. This is one of the most significant benefits for people who want to minimize banking costs.

-

Limited Accessibility: While credit unions may offer great rates, they often have fewer branches and ATMs compared to large banks. This can be a drawback for people who need frequent in-person services or who travel often.

-

Membership Requirements: Credit unions often have membership requirements, meaning you must meet certain criteria to join, such as working in a specific industry or living in a certain area.

What is a Bank?

Banks are for-profit financial institutions that can be either privately owned or publicly traded. Banks tend to be larger institutions with more resources and a broader reach, offering services to individuals, businesses, and corporations across the globe. While they may not offer the same personal service as credit unions, they provide a vast array of products and services with wider accessibility.

Key Features of Banks:

-

For-Profit and Shareholder-Owned: Banks operate with the goal of generating profits for shareholders, which can sometimes result in higher fees or interest rates. However, this structure allows them to offer a broad range of financial products and services.

-

Comprehensive Services: Banks offer a wide range of financial products and services, from checking accounts and loans to business financing, investment opportunities, and international banking.

-

Greater Accessibility: Banks generally have more branches and ATMs, making them more convenient for customers who need access to physical locations. This is particularly important for people who travel frequently or live in areas far from credit unions.

-

Technology and Online Services: Banks tend to offer more advanced online and mobile banking services, which can make managing your money much easier and more convenient, especially for tech-savvy customers.

-

Less Personal Service: Due to their larger size and more transactional nature, banks may not offer the same level of personalized service that you would find at a credit union. You may be treated more like a number rather than an individual with unique needs.

How to Decide: Credit Union vs. Bank

When deciding between a credit union and a bank, consider what matters most to you in a financial institution:

-

Rates and Fees: If you're looking for lower rates on loans and higher interest on savings, a credit union may be a better fit. However, if you need a more extensive range of financial products, a bank might be more suitable.

-

Service and Support: If personalized service is important to you, a credit union may be the right choice. On the other hand, if you value convenience and technological offerings, a bank may be better equipped to meet your needs.

-

Access to Locations and ATMs: If you travel often or need widespread access to ATMs and physical branches, a bank may be the best option. Credit unions can be more limiting in this regard, though they may have agreements with other institutions to provide shared ATM access.

-

Membership Eligibility: Credit unions typically have eligibility requirements for membership, so check if you meet the necessary criteria before considering this option. Banks, in contrast, are open to everyone without restrictions.

-

Business Services: If you need business banking services, a bank might be a better choice as they often have more extensive business loans and credit options.

There is no one-size-fits-all answer when it comes to choosing between a credit union and a bank. Your decision will depend on factors like the types of services you need, your budget, and how important convenience and personalized service are to you. If lower fees, better rates, and community feel are what you value, a credit union could be the right fit. If you require more specialized services, greater accessibility, or advanced online banking options, a bank may be the way to go.

Ultimately, take time to evaluate both options and choose the one that aligns best with your financial goals.